Financial Mastery Program

Build real-world budget optimization skills through hands-on learning, expert mentorship, and practical case studies that prepare you for success in Australia's evolving financial landscape.

Months Duration

Practical Exercises

Learning Support

Client Projects

Your Learning Journey

Foundation Phase

Months 1-4

Start with fundamental concepts and build your understanding of Australian financial systems. You'll work through real budgeting scenarios and learn the tools professionals use daily.

- Personal and business budget fundamentals

- Australian tax system navigation

- Financial software proficiency

- Risk assessment basics

Intermediate Development

Months 5-10

Dive deeper into advanced budgeting strategies and optimization techniques. Work with real client cases and start developing your analytical skills through guided projects.

- Advanced cash flow analysis

- Investment planning strategies

- Client consultation skills

- Market research techniques

Professional Practice

Months 11-15

Apply your skills in supervised real-world scenarios. Handle actual client consultations and develop comprehensive budget optimization plans under expert guidance.

- Live client project work

- Professional presentation skills

- Industry networking opportunities

- Specialist track selection

Capstone & Transition

Months 16-18

Complete your capstone project and prepare for professional practice. Focus on building your portfolio, refining your expertise, and connecting with industry professionals.

- Independent capstone project

- Professional portfolio development

- Industry mentor matching

- Continuing education pathways

Comprehensive Curriculum Design

Our program combines theoretical knowledge with practical application. Each module builds upon previous learning while introducing new challenges that mirror real-world financial consulting scenarios.

Core Financial Analysis

Master budget creation, variance analysis, and financial forecasting using industry-standard tools and methodologies.

Client Relations

Develop communication skills for explaining complex financial concepts to diverse client demographics.

Technology Integration

Work with modern financial planning software, automation tools, and data visualization platforms.

Regulatory Compliance

Navigate Australian financial regulations, licensing requirements, and ethical considerations.

Questions at Every Stage

Before You Start

- What background knowledge do I need to succeed in this program?

- How much time should I expect to dedicate each week?

- Are there specific software or equipment requirements?

- What makes this program different from online courses?

- How do I know if financial consulting is right for me?

During Your Studies

- What support is available when I'm struggling with concepts?

- How often will I work with real client scenarios?

- Can I balance this program with full-time work?

- What happens if I need to take a break from studies?

- How do peer collaboration and group projects work?

After Completion

- What career paths are typically available to graduates?

- Do you provide ongoing professional development opportunities?

- How can I stay connected with the alumni network?

- What additional certifications might enhance my credentials?

- Is there support for starting my own consulting practice?

Industry Expert Perspectives

Learn from professionals who've guided thousands of clients through successful budget optimization journeys across Australia's diverse financial landscape.

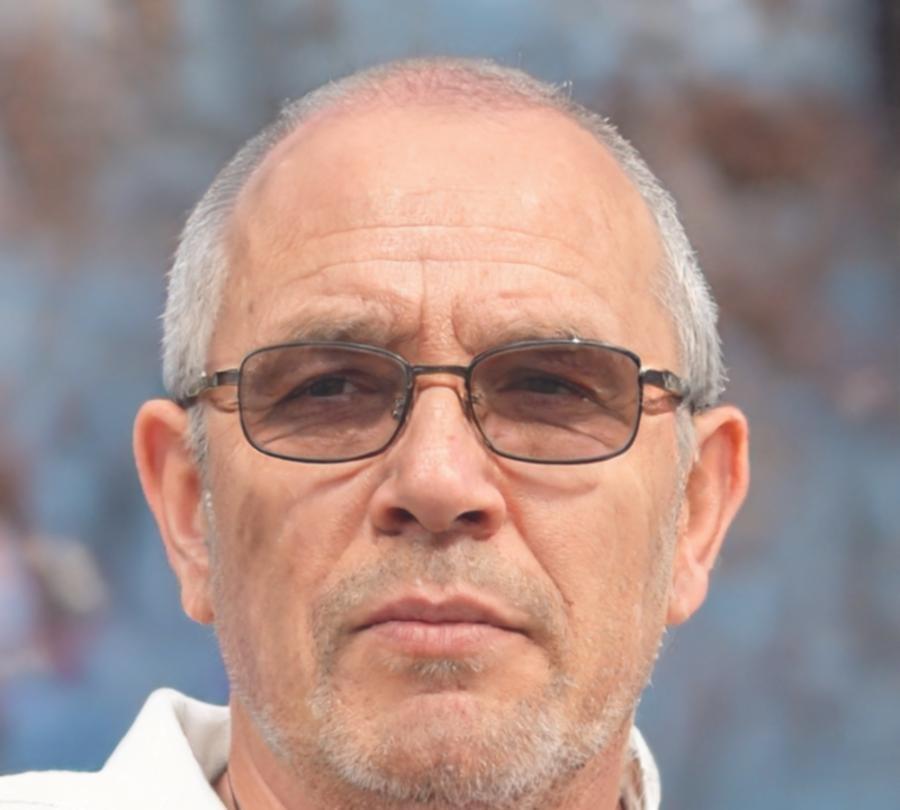

Marlowe Chen

Senior Financial Consultant

The most successful graduates I've mentored are those who embrace the messiness of real client situations. Theory gives you the framework, but every family's financial story is unique. Our program teaches you to listen first, then apply your technical skills thoughtfully.

Kester Nakamura

Budget Optimization Specialist

What surprised me most when I transitioned into this field was how much psychology is involved. You're not just crunching numbers – you're helping people change their relationship with money. The communication skills you develop here are just as valuable as the technical expertise.

Indira Volkov

Business Financial Advisor

The Australian market has its own rhythm and regulations. Our students get hands-on experience with GST implications, superannuation planning, and state-specific considerations that you simply can't learn from generic international courses. It's practical knowledge that makes a real difference.

Briony Castellanos

Program Development Lead

We constantly update our curriculum based on industry feedback and emerging trends. The financial landscape changes rapidly, and our graduates need to be adaptable. We focus on teaching fundamental problem-solving approaches rather than just current best practices.